- Early in my 20s, I was reckless with money and didn’t yet understand the value of saving and investing.

- Since meeting my wife, Alexandra, five years ago, we have been able to increase our income, build profitable side hustles, and establish real financial goals.

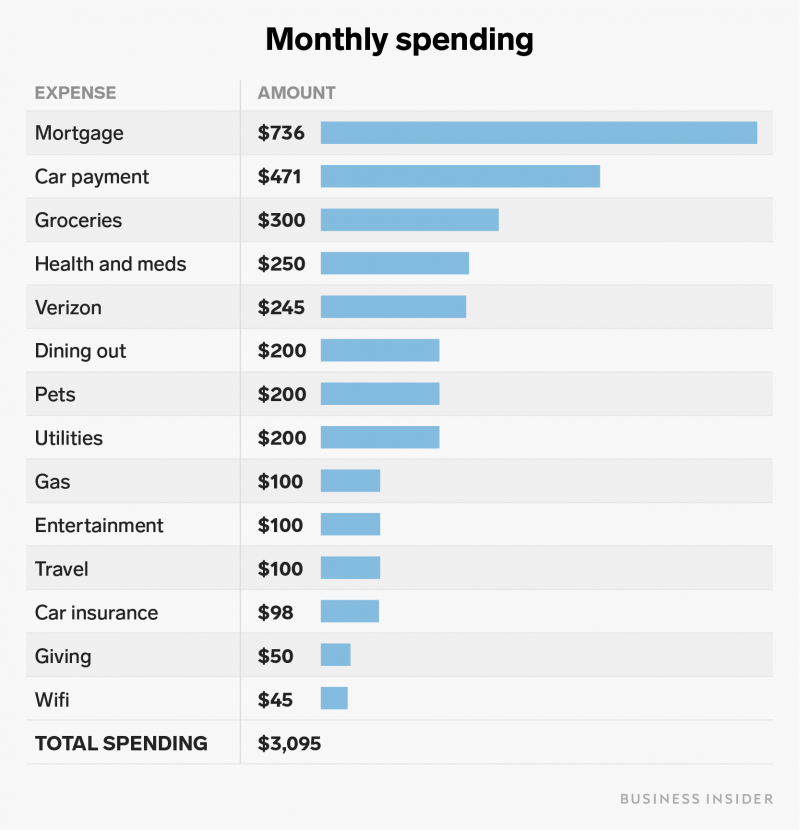

- Now we make regular contributions to our retirement accounts, have an emergency fund, and keep our monthly expenses around $3,000 – except for the occasional pet emergency.

- Read more personal finance coverage.

I come from a place of past addiction. Prescription drug addiction, cigarette addiction, alcoholism, spending, etc. You name it, I could probably get addicted to it.

The spending part is important because when you turn to so many vices to deal with your emotions, spending becomes a nice comfort. I spent money on anything from shopping sprees on my lunch breaks to weekend partying and buying whatever for whoever, it didn’t matter.

I don’t know why, but it never registered in my head to save that money and to stop blowing it. It doesn’t matter how many times my parents told me when I grew up to save as much of my money as I can and invest it, when you’re young and have no interest or real understanding of it, you just don’t care.

As I kept advancing in my career and increasing my income, I would increase my spending. It wasn’t until I met my wife, Alexandra, five years ago that I really started thinking and caring about my life.

We still spent recklessly together. A little before we got married there was a weekend where we had nothing left in our bank accounts and actually had to rally up clothes and shoes of ours to sell at a local thrift shop. We made about $50 that was able to get us through that next week until our next paycheck. I call it "toxic side hustling" when you hustle for extra money because your income has run out, and you could have chosen to avoid it. As sad as that sounds, it helped us realize that we could be doing so much better if we just made an effort with our money.

We are beyond grateful that we have been able to increase our income and skill sets and found the online personal finance community to help us get our wheels turning on what we really want out of life.

Now we save thousands of dollars a month

Alexandra and I live near St. Louis, Missouri, and now work in information technology, earning a combined annual salary of a little over $160,000 before taxes and anything else that gets taken out of that. This figure does not include our income from our side businesses, which make an additional $2,000 to $4,000 a month.

When it comes to what gets taken out of our pre-tax salary, that's health insurance ($110 every paycheck for the both of us from my paycheck, since it was the better coverage), vision and dental, life insurance, disability, 401(k) contributions, IRA contributions, and taxes.

We each contribute 20% to our 401(k) and IRA retirement accounts for the time being (we're slowly increasing that every couple of months) and that doesn't include company matches. We also put money into our joint portfolio at M1 Finance every month and put about $1,000 to $2,000 a month into our high-yield savings account, which holds our $15,000 emergency fund.

Now we are working towards our moving fund, future land and house down payment fund, and to rebuild our travel fund after tapping it out.

Our budget is pretty much fixed - until it comes to pet expenses

We are also extremely grateful to live in St. Louis because of its low cost of living. Our monthly budget comes in at around $3,000 for all of our expenses. Sometimes it goes up or down in the medical and pet categories as well as any food spending or unexpected expenses with house and car maintenance.

Speaking of pet expenses: They can definitely tip the scale of our spending. Usually we manage to keep our pet expenses between $200 to $250 a month and with two dogs, five cats, and a couple of tarantulas.

But back in February, for example, our smallest tuxedo cat got struvite crystals and we had to make an emergency visit to the vet. After a small procedure and four days of in-patient care, we were looking at a $1,400 vet bill. Thankfully we had saved for these unexpected pet expenses in our emergency fund.

Our ultimate goal is to be financially independent

We love the west coast - especially Oregon, Northern California, and parts of Washington - and are preparing to move there in the near future (we will see how that goes with transporting seven pets across the country).

You'd think the west coast is all high cost of living areas and expensive housing, but it's not. In the more rural areas where we want to live, we found some very affordable houses in good shape on a couple of acres of land.

What are aiming to build up our passive income streams and our side businesses to completely support us as we live semi off-grid. As much as we enjoy our current day jobs, we don't want to live the rest of our lives according to someone else's schedule.

That doesn't mean full retirement for us, though. As much as that would be nice, we will still be raking in some sort of income from our business ventures and passive income streams. We may even choose to work part-time if remote work is an option.

Where it gets tricky are the unexpected expenses that come with having special needs animals, medications and other health needs, and parents who will need elderly care in the next 20 years. Kids are not a part of our plan so we don't need to worry about that. We have to make sure we have enough of a plan and stockpile of cash before we completely say goodbye to our day jobs and their comfortable benefits.

We are very close to paying off our last remaining debt: our car loan. We still have the mortgage but will sell our house soon to move out west. When we move we plan on having a hefty down payment, but we plan for our monthly payments to be no more than they are now ... hopefully cheaper.

We also want to have leisure time to relax and enjoy ourselves. One of our biggest fears of stepping away from corporate life and diving into our side businesses full force is losing that stability a corporate job provides. And the healthcare.

The amount we would be able to save would also decrease, which is something that I haven't yet come to terms with. However, if we can get our side income and passive income sources up to the level we are working towards and get more projects going, we might not even miss a beat. We are going to continue to dream big.